Know the difference between a Credit Date and a Deposit Date

As we end 2018 and begin to think about tax receipts, it's useful to understand the differences between Credit Date and Deposit Date.

A typical transaction in Gift Entry usually involves using a Credit Date and a Deposit Date that are the same. However, at the end of the calendar year, there are occasions where these dates differ, and it's useful to have a solid understanding of how these different dates are used. In ENTERPRISE, a Deposit Date is relatively straightforward. It is a financial date which automatically generates the corresponding fiscal year and fiscal period. Throughout ENTERPRISE the Deposit Date is used to capture the date upon which the financial activity actually takes place. Deposit Dates aid in bank reconciliation processes.

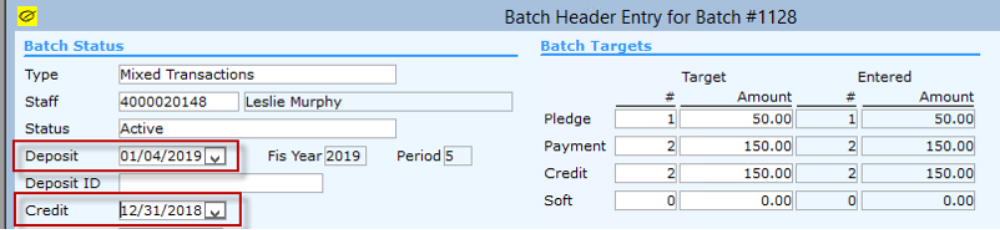

The Credit Date is the date on which the donor should receive fundraising credit for the transaction. It may be helpful to think of a Credit Date as the date that your donor feels the gift was received by your organization. The example batch header above illustrates a scenario where Credit and Deposit Dates differ. The checks in Batch 1128 have been deposited on January 4th, but the Gifts attached are from donors receiving 'credit' for the preceding tax year; thus they have a Credit Date of 12/31/2018. These dates are not to be confused with the Processed Date, which is the date that a Batch has been processed or released. This date may be completely different than the Deposit Date and/or the Credit Date depending upon the turnaround time for transaction processing.